|

|

| THE HASSLE-FREE EMPLOYEE RETENTION PROGRAM |

|

|

|

|

|

|

|

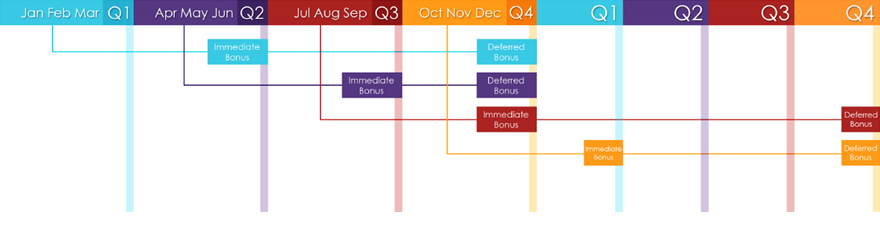

| SIMPLE VERSION EXPLAINED To use the "simple version" all the employer needs to do is the following: - Once you have created an account with works4us, go to the sign up area and enter the employees details, - create a password for the employee , - select "simple version" where you are prompted to enter a dollar amount in a field and that's it. The system creates a contract for both (employer and employee) to sign and then the system automatically creates the future monthly statements. Under the simple version, the payment is then split at default 50/50 meaning that the employee would be paid 50% of the month's reward at the end of the next quarter (which we refer to as the immediate bonus) and then the remainder (which we call the deferred bonus) will be paid on the last day of December after the conclusion of the completed financial year . For example: the immediate bonus earned in the June 2011 quarter would be paid at the end of September 2011 and the deferred part of the bonus is paid at the end of December 2011. An "immediate bonus" earned during the September 2011 quarter (which is also the beginning of a new financial year) would be paid at the end of December 2011 and the "deferred " part of the bonus earned during the September 2011 quarter is paid at the end of December 2012 (next Calender year, that is the December of next year). In the "simple version" the employer can still: - make comments on the monthly statements, - make additions, - Include deductions or cash advances (all these features are also in the full version). Any additions are spread throughout the timelines of the system however if a cash advance is approved by the employer, the cash advance amount is taken out of the next due quarterly payment.

|