| EXAMPLES

Thanks for clicking to see some examples.

We choose to reward our employees by a percentage of their individual sales because we are able to do this with our accountancy program but this is not the same for all business's as some employees are part of the team and it can be challenging to calculate exactly how much they brought into your business, so you may prefer to give them a share of company sales or profit "as determined by you". Talk to your employee about this when signing them up .

If you were to select "Other Performance indicators", you would need to give your indicator a name in the small box next to "Other Performance indicators", and this will carry through to the agreement

You may want to talk to your accountant or financial adviser first, it's up to you.

EXAMPLE Let's say you have an employee that you would like to pay an extra $100 a week to keep and you can identify that this employee brings in sales of approximately $20,000 a month.

Go to step 1, select individual sales then go to step 2 and enter any additional terms or conditions to appear on the agreement

( In this box you could add reference to your workplace agreements, vehicle policy, company policy and procedures etc or whatever you want to have appear on the agreement for signing . As we said earlier, If you were to pick "Other Performance indicators", you would need to name your indicator in the small box next to "Other Performance indicators", and this will carry through to the agreement.)

Now go to step 3 and enter 2%. The reward would be calculated at $400 a month. Now of course this will vary up or down depending the sales .

Either way we suggest you experiment with the figures and do a test run, go and have a look at the employee statements enter some figures and you can always come back and change the percentage before you both sign. Remember that you would need to consider any legislative additions like Superannuation or work Cover if this is applicable.

If it's your first time using this system , it may take a few goes .Once you've entered the percentage scroll down to where you split the reward.

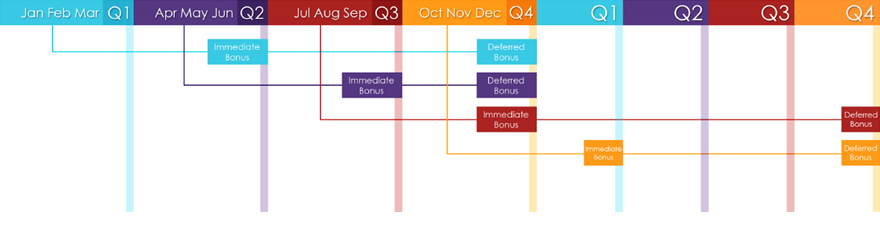

In this next percentage box you will choose what percentage of the bonus is paid at the end of the next quarter (which we refer to as the immediate bonus) and then the remainder (which we call the deferred bonus) will be paid on the last day of December after the conclusion of the completed financial year, the video also shows a flowchart with the timelines for payment.

So for example the immediate bonus earned in the June quarter would be paid at the end of September and the deferred part of the bonus is paid at the end of December of the same year

An "immediate bonus" earned during the September quarter (which is also the beginning of a new financial year) would be paid at the end of December of the same year and the "deferred " part of the bonus earned during the September quarter is paid at the end of the December next Calender year, that is December next year.

I'd like to point out now that this is the key component to the success of this program.

This is to reduce the times an employee may wait until the end of the year , take their payment and go in which case they would see on their statement that they would miss out on any bonus earned in the last quarter of the year AND the retained or deferred amount preserved towards the end of next year.

|